今天,我们来给大家继续分享IG经济学真题与答案解析,IGCSE的特色就是考法会有重复率,因此熟悉往年的题目是非常能给大考加分的。

IGCSE经济考试特点

IGCSE经济考试由2张paper构成。

paper1为选择题卷,paper2为论述题卷,包含数据分析和essay写作。

1.选择题共30分,对中国学员而言可避开长篇英文论述的要求。

2.数据分析30分,分值较大,这部分IG经济学真题需要重点练习。

3.三道essay写作题,共90分,分值较大。essay既有宏观也有微观,学员可根据自身情况进行选择。

Paper1 试卷1是选择题,总分30分,在总成绩中所占比重为30%

Paper2 试卷2是客观题(问答形式),总分90分,在总成绩中所占比重为70%

IG经济学真题与解析

27. The government of a country used fiscal policy to achieve price stability. What is another way of saying this?

a) The government increased taxes to achieve low inflation.

b) The government reduced the money supply to achieve low inflation.

c) The government used interest rates to achieve economic growth.

d) The government used restrictions on banks to achieve stable exchange rates.

Key A

CIE:In Question 27.26% of the candidates thought that fiscal policy related to money supply and chose B.A was correctly chosen by 39% This appears to be a result of a confusion of the definitions of fiscal and monetary policy.

Ming:fiscal policy involves changing the total level of taxation or goverment spending in an economy to

influence the level of demand for goods and services, V

a) it is fiscal policy meanwhile it reduces price level, b)money supply is monetary policy.c) interest rate is monetary policy,d)it is exchange rate policy.

The sum of indirect tax=10+75+300=385

28. Which is a description of indirect taxes? a) They are easy to avoid and deter effort. b)They are levied on income and cause inflation. c) They are levied on spending and are regressive. d) They are progressive and discourage consumption.

本道IG经济学真题答案为C。

Sweet hint: indirect taxes are levied on consumer spending on goods and services and are regressive in nature.

29.In a country, income tax is charged at $50 on an income of $500.

Compared with this.which of the following would indicate that the income tax scale was progressive? a) $150 tax on $2000 income b)$300 tax on $3000 income c)$450 tax on $4000 income d)$480tax on S5000 income Kev C

CIE:44%choseB in Question29,confusing a proportional tax with a progressive tax.The correct answer wasC which was selected by 26% of the candidates.

Sweet hint: A progressive income tax system takes a greater proportion of income in tax as income rises. At an income of $500,the tax rateis 10% and at an income of $4000,the tax rate is 11.25%, indicating a regressive system,so not Option A: At an income of $3000,the tax rate is 10%, indicating a progressive system,so not option Bwhile at $5000,the tax rate is 9/6%,indicating a regressive system,so not option D

今日份IG经济学真题就分享到这里啦。IGCSE经济是一门人气很高的选课,但很多IG学员之前从未接触过经济学,对经济学的认知几乎为零,无形之中加剧了适应难度,有需要的话可以点击预约试听【IGCSE同步培训班】——

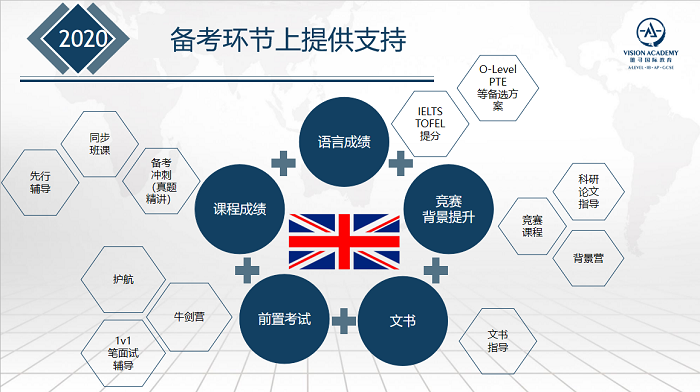

开设IGCSE15+科目辅导

内容适应多个考试局

国际课程辅导团队+助教+个人顾问

多对一教学模式

针对学员的学习习惯

定制课程内容

不要小看GCSE这段“适应期”,这个成绩可是分隔普通学员与大神的一道分水岭,也是牛校发录取通知时重要的参考因素。

更多IGCSE / GCSE学习攻略点击

沪公网安备 31010502004453号

沪公网安备 31010502004453号

成功提交后我们将尽快与您联系,请注意来电哦!

成功提交后我们将尽快与您联系,请注意来电哦!